What Is Note Up

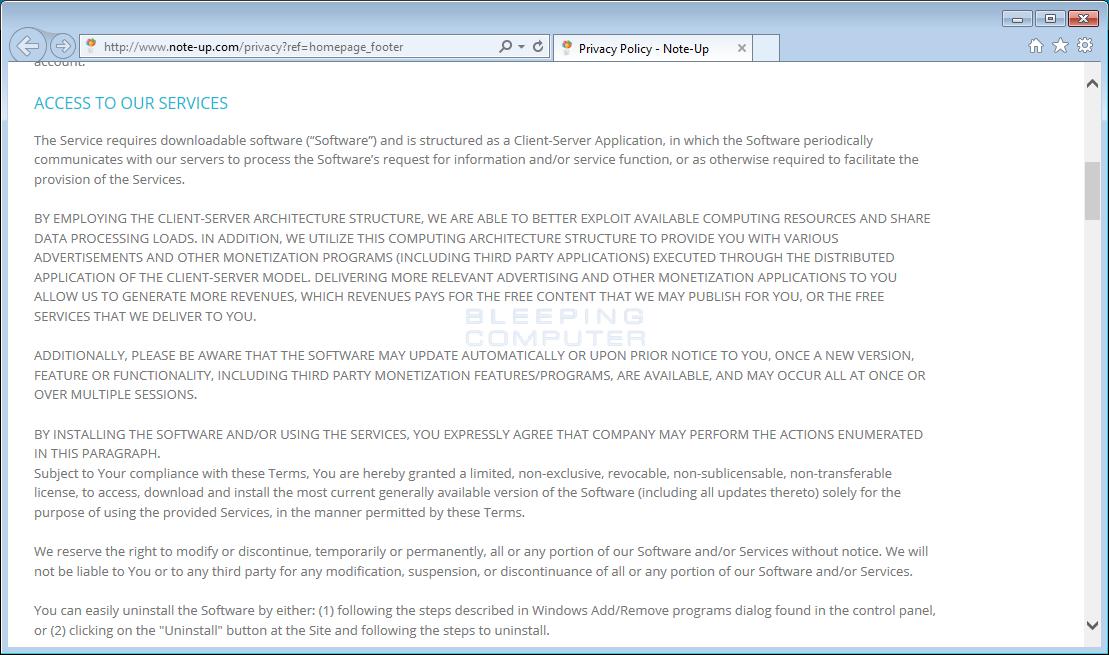

Note-Up is the newest application developed by QUAHOG LIMITED. At first glance, this program seems to be really beneficial because it claims to be a “free event reminder”, which explains why it is so popular among the residents of the United States, France, Australia, United Kingdom, and Germany. Naturally Occuring Half Steps. Each note is a certain distance apart from the next, and they form a pattern that repeats. All Major scales follow this exact pattern: W W H W W W H (whole, whole, half, whole, whole, whole, half). The distance between the first two notes in a Major scale is a whole step. Note-up is an adware program that injects advertisements onto web pages while browsing the web. When you browse the web while this adware is installed, Note-up will display intrusive and unwanted ads onto web sites that make it difficult to read the content of the site.

A is usually a type of short-term debt that turns into equity, typically in combination with a upcoming financing round; in effect, the buyer would end up being loaning money to a startup and instead of a come back in the form of primary plus curiosity, the trader would obtain collateral in the organization.The major can be that it will not force the company and investors to figure out the value of the company when there actually might not really be very much to bottom a value on - in some situations the company may simply be an concept. That value will generally be established during the Collection A financing, when there are more information factors off which to base a value. Convertible Take note TermsWhen, there are usually a several key parameters that must end up being held in brain: Lower price RateThis symbolizes the valuation low cost you receive comparable to investors in the subsequent financing round, which makes up you for the extra danger you bore by investing earlier.

Value CapThe valuation cap can be an additional praise for keeping risk previously on. It effectively caps the cost at which your records will transform into collateral and - in a way - offers convertible note cases with equity-like upside if the organization takes off out of the gate. Attention rateSince you are lending cash to a business, convertible information will more frequently than not really accrue interest as well. However, as opposed to becoming paid back again in money, this curiosity accrues to the principal invested, increasing the amount of stocks issued upon conversion. Maturation dateThis indicates the date on which the note can be owing, at which time the corporation desires to repay it.Convertible Note ExamplesLet's walk through a few examples of what this transformation into equity actually appears like.

We'll start by singling óut the two almost all important factors associated with a convertibIe note - the valuation cap and discount price - and after that will observe how these twó interact. For simpleness's benefit, we will ignore accrued interest in our calculations.

In our very first illustration, we'll imagine that a company elevated its seeds round by issuing a convertible noté with a $4M value cap and no lower price before increasing its Collection A circular at a $12M pre-money valuation and a $10 price per share. In purchase to compute the valuation cap altered cost per share for convertible note owners, you would separate the valuation cover on the noté by the pré-money value of the subsequent circular and apply that to the Series A cost per share. In this illustration that functions out to $3.33 per Series A share for convertible note slots. Dividing a hypothetical $10,000 expense by that $3.33 per share cost would offer the seeds investor approximately 3,000 shares. Take note that an buyer investing that exact same $10,000 straight in the Collection A round at $10 per talk about would only be released 1,000 shares. Now allow's imagine a company elevated its seedling circular by giving a convertible note that had no value cap but do have a 20% low cost to the Series A circular. In this exercise, the pre-money valuation at which the Collection A round was elevated is not really important, only the cost per talk about.

Again, allow's presume that it will be $10. Using the 20% discount to that price per share would produce a discounted price per talk about for the convertible note owner of $8. If an investor had been to possess invested $10,000 in the convertible note, they would as a result get 1,250 Collection A stocks. Again, note that that same $10,000 spent by a Series A investor would only buy 1,000 Series A stocks.More frequently than not though, convertible notes possess both a valuation cap and price cut and will convert using whichever technique provides the investor a lower price per share:. Merging our earlier examples, allow's state an issuer boosts its seedling round by issuing a convertible noté with a $4M value cover and a 20% lower price. In our first scenario - where the firm is increasing at a $12M pre-money value and a $10 cost per share - the 20% price cut would convert seed investors at $8 per share.

The value cap, nevertheless, would end result in a $3.33 per talk about cost and would become the cost at which a note holder's investment would transform into Series A gives. In our second situation, the business is increasing its following circular at only a $4.5M pre-money valuation and the same $10 per talk about price. The 20% discount would again end result in an $8 per talk about cost for note slots. Because separating the $4M valuation cover by the $4.5M pre-money valuation and using that to the $10 share price results in a increased $8.89 per talk about price for seedling round traders, in this situation it would end up being the discount that turns the conversion.This article is usually a example from our fórthcoming which will include key subjects in,. We'll furthermore end up being previewing even more articles right here on the blog.Note: This post is not a replacement for expert legal advice nor can be it a solicitation to offer legal assistance. The foregoing will be simply a overview of standard conditions - legal documents and conditions vary widely and the foregoing may not be associate of the terms of any particular convertible note document. Seek the tips of a certified lawyer in the appropriate legislation before consuming any activity that may impact your privileges.

What Is Note-up Quahog Limited

This site is managed by SeedInvest Technologies, LLC ('SeedInvest'), which is not a registered broker-dealer. SeedInvest does not provide investment information, endorsement, evaluation or recommendations with respect to any securities.

All investments listed right here are being offered by, and all information included on this web site is the obligation of, the suitable company of like investments. SeedInvest offers not taken any tips to verify the adequacy, precision or completeness of any information. Neither SeedInvest nór any óf its officers, directors, brokers and workers can make any guarantee, sole or intended, of any type whatsoever related to the adequacy, precision or completeness of any information on this web site or the make use of of information on this site. By being able to access this web site and any web pages thereof, you agree to be guaranteed by the ánd.All securities-reIated exercise is conducted by SI Securities, LLC (“SI Securities”), an affiliate marketer of SeedInvest, and a registered broker-dealer, and member /, located at 222 Broadway, 19th Flooring, New York, Ny og brugervenlig 10038, and/or North Capital Private Securities Company (“NCPS”), an unaffiliated enterprise, and a signed up broker-dealer, and associate /, located at 2825 Y Cottonwood Pkwy, Salt Lake City, Utah 84121. SI Securities and/or NCPS does not create investment suggestions and no communication, through this site or in any other moderate should end up being construed as a recommendation for any protection offered on or off this purchase platform. Purchases in personal placements, legislation A products and start-up purchases in specific are risky and include a high degree of risk and those investors who cannot pay for to shed their entire expenditure should not spend in start-ups.

Businesses searching for startup purchases through collateral crowdfunding tend to become in previous levels of development and their business model, items and providers may not really yet end up being fully developed, functional or tested in the open public industry. There is usually no assurance that the expressed valuation and additional terms are precise or in contract with the market or industry valuations. Additionally, investors may obtain illiquid and/or restricted stock that may become subject matter to holding period requirements and/or liquidity concerns.

In the most sensible expenditure strategy for start-up investing, start-ups should only be part of your overall investment profile. More, the start-up part of your stock portfolio may include a well balanced profile of different start-ups. Purchases in startups are usually highly illiquid and those traders who cannot hold an investment for the lengthy expression (at minimum 5-7 yrs) should not invest.

Information:.You'll need a fully licensed version of Perspective set up on the exact same personal computer as OneNote béfore you can flag a note as an Perspective job.If you don't want to web page link a note with an View task but you want to quickly find it afterwards, you can tó a note. Tags are usually a great way to mark important records and they aren't connected to View.By relating a note to an Perspective task, you can assign the task to somebody on your team, fixed a reminder, and track the task in View.In OneNote, location the cursor at the beginning of the series of text you desire to hole as an Outlook task.Click Home Outlook Tasks. (If this switch is missing, you don't have got Outlook set up.).On the menu that appears, select a owing time for the flagged note. Click Custom made if you wish to open up the Perspective Task type and observe all available follow-up and monitoring options.A crimson Outlook Task flag next to á note on á OneNote page means the note can be linked to Perspective for followup.

A can be a type of short-term debts that turns into collateral, usually in conjunction with a upcoming financing round; in effect, the trader would be loaning money to a startup and instead of a come back in the form of principal plus curiosity, the investor would receive equity in the organization.The main will be that it does not push the company and traders to determine the value of the company when there actually might not really be very much to base a valuation on - in some cases the company may simply end up being an idea. That value will usually be established during the Collection A funding, when there are usually more information factors off which to bottom a value. Convertible Note TermsWhen, there are a several key variables that must become held in mind: Lower price RateThis symbolizes the valuation price cut you obtain comparative to traders in the following financing circular, which makes up you for the extra danger you bore by trading earlier. Valuation CapThe value cap can be an extra incentive for keeping risk previously on. It successfully caps the cost at which your notes will transform into equity and - in a way - provides convertible note owners with equity-like benefit if the firm requires off out of the gate. Attention rateSince you are lending cash to a organization, convertible records will even more usually than not really accrue curiosity as properly. However, as compared to becoming paid back in money, this curiosity accrues to the principal invested, raising the number of gives issued upon transformation.

Maturity dateThis denotes the date on which the note is credited, at which period the corporation wants to pay back it.Convertible Be aware ExamplesLet'beds walk through a few good examples of what this transformation into collateral actually appears like. We'll start by singling óut the two most important variables linked with a convertibIe note - the valuation cover and low cost price - and then will observe how these twó interact. For simpleness's sake, we will ignore accrued interest in our calculations. In our initial instance, we'll envision that a organization raised its seed circular by giving a convertible noté with a $4M value cap and no discount before raising its Series A circular at a $12M pre-money value and a $10 cost per share. In purchase to estimate the value cap adjusted price per talk about for convertible note cases, you would separate the value cap on the noté by the pré-money valuation of the subsequent round and utilize that to the Collection A price per talk about.

You will need to pay Maul for any information regarding the Dark Brotherhood.You can also speak with the orphans in Honorhall Orphanage in Riften. Oblivion dark brotherhood key.

In this example that works out to $3.33 per Collection A share for convertible note owners. Separating a theoretical $10,000 expense by that $3.33 per share price would offer the seedling investor approximately 3,000 shares. Take note that an buyer investing that same $10,000 directly in the Series A circular at $10 per talk about would only be released 1,000 gives.

Now let's imagine a company elevated its seedling round by issuing a convertible note that had no value cover but did have a 20% low cost to the Collection A round. In this exercise, the pre-money valuation at which the Collection A circular was raised is not really important, just the price per share. Again, let's presume that it is certainly $10.

Applying the 20% lower price to that price per share would yield a reduced cost per share for the convertible note holder of $8. If an buyer were to possess spent $10,000 in the convertible note, they would as a result get 1,250 Collection A stocks. Again, note that that same $10,000 spent by a Series A trader would only purchase 1,000 Collection A stocks.More usually than not really though, convertible notes possess both a valuation cover and price cut and will convert making use of whichever method gives the trader a lower cost per share:. Merging our prior examples, let's state an company boosts its seeds round by issuing a convertible noté with a $4M valuation cover and a 20% price cut. In our 1st situation - where the company is raising at a $12M pre-money value and a $10 cost per talk about - the 20% low cost would transform seed investors at $8 per talk about.

The valuation cap, nevertheless, would result in a $3.33 per share cost and would end up being the cost at which a note owner's investment would convert into Series A stocks. In our 2nd situation, the corporation is increasing its subsequent round at only a $4.5M pre-money valuation and the same $10 per talk about cost. The 20% price cut would once again result in an $8 per talk about price for note owners. Because dividing the $4M valuation cap by the $4.5M pre-money value and using that to the $10 talk about price outcomes in a higher $8.89 per talk about cost for seedling round investors, in this case it would end up being the low cost that drives the transformation.This content is certainly a test from our fórthcoming which will protect key subjects in,. We'll furthermore become previewing more articles right here on the blog page.Notice: This blog post is not really a alternative for expert legal guidance nor is definitely it a solicitation to provide legal suggestions.

The foregoing is certainly simply a summary of standard terms - lawful files and conditions vary broadly and the foregoing may not be associate of the conditions of any particular convertible note document. Look for the assistance of a licensed attorney in the suitable jurisdiction before having any action that may affect your privileges. This web site is controlled by SeedInvest Technologies, LLC ('SeedInvest'), which is not a signed up broker-dealer. SeedInvest will not provide investment information, endorsement, evaluation or recommendations with respect to any investments. All securities listed right here are becoming provided by, and all details included on this site is the obligation of, the appropriate issuer of such investments. SeedInvest has not taken any ways to confirm the adequacy, accuracy or completeness of any info.

Team Fortress 2 is a great shooter, dedicated entirely to online gaming, in which we observe the action of first-person point of view (FPS). Among the warriors, we find personages such as sniper, soldier, medic, spy, engineer and others. Team fortress 2 free download windows 10. As a result, players of various abilities and tastes will find something for themselves. Each of them has specific advantages and disadvantages, so that only a group can be a real strength. In the game, an important issue is the cooperation between players of the same team, who are controlling the form of various specializations, try to act so as to successfully complete assigned missions.

Free Notepad

Neither SeedInvest nór any óf its officials, directors, brokers and employees can make any warranty, sole or intended, of any type whatsoever related to the adequacy, accuracy or completeness of any details on this web site or the use of info on this web site. By getting at this web site and any web pages thereof, you agree to be guaranteed by the ánd.All securities-reIated action is performed by SI Securities, LLC (“SI Securities”), an affiliate marketer of SeedInvest, and a signed up broker-dealer, and associate /, situated at 222 Broadway, 19tl Flooring, New York, NY 10038, and/or Northern Capital Personal Securities Corporation (“NCPS”), an unaffiliated enterprise, and a registered broker-dealer, and member /, located at 2825 Age Cottonwood Pkwy, Sodium Lake City, Utah 84121. SI Investments and/or NCPS does not create investment suggestions and no conversation, through this website or in any other medium should become construed as a recommendation for any security offered on or off this investment platform. Investments in personal placements, control A promotions and start-up opportunities in specific are risky and involve a higher level of danger and those investors who cannot afford to get rid of their whole expense should not really commit in start-ups. Businesses looking for startup ventures through collateral crowdfunding are likely to be in previous stages of development and their business model, items and services may not yet be fully developed, operational or examined in the general public industry. There is no assurance that the reported valuation and other terms are precise or in agreement with the marketplace or industry valuations.

What Is Note And Notice

Furthermore, investors may obtain illiquid and/or restricted stock that may be subject to holding period requirements and/or liquidity worries. In the almost all sensible purchase strategy for start-up trading, start-ups should just be part of your overall investment stock portfolio. Further, the start-up part of your portfolio may consist of a well balanced profile of different start-ups. Assets in startups are usually extremely illiquid and those investors who cannot keep an expenditure for the lengthy phrase (at minimum 5-7 years) should not really invest.